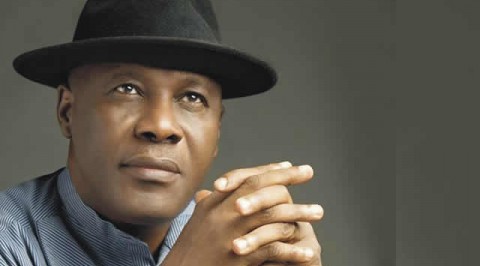

Goodluck Jonathan – $2.9tn Needed To Develop Infrastructure

President Goodluck Jonathan has said the country needs about $2.9tn investment layout to develop infrastructure over the next 30 years.

The President said this at the Nigeria Power Sector Investors’ Conference held at the Banquet Hall of the Presidential Villa in Abuja on Monday.

Jonathan, who was represented by Vice-President Namadi Sambo, explained that a significant percentage of the sum for infrastructure development was expected to come from the private sector.

Jonathan said, “Under our Integrated National Infrastructure Master Plan, we need a total of $2.9tn for our infrastructure developmental efforts in the next 30 years, from 2014 to 2045.

“The energy sector alone needs an infusion of $900bn during the period Of this, a significant percentage is expected to come from the private sector.

“The power sector alone needs about $10bn for CAPEX of the generation and distribution companies in the next few years in enabling us to add additional 5,000MW.

“Similarly, our transmission network continues to attract serious attention. The transmission grid requires an annual investment of about $1.5bn for the next five years to ensure its reliability and stability.

“The Transmission Company of Nigeria has commenced the aggressive implementation of the expansion blueprint funded by a mix of appropriation and funds from financial and multilateral institutions.”

The President stated that at present, only about 55 per cent of the country’s population had access to electricity.

He said, “This arises mainly from the fact that Nigeria’s per capital electricity generation is relatively one of the lowest in global terms. Even then, power supply from the national grid still remains as low as 50 per cent.

“In order to meet our strategic national economic growth and developmental goals as encapsulated in the Vision 2020 and the transformation agenda, we needed to take decisive and courageous measure to work towards a 40,000MW target in the years ahead. This informed our decision on reform and privatisation.”

On why the private sector was better suited to effectively manage and attract the huge capital required for constant and affordable electricity supply to all Nigerians, Jonathan said private investors had a track record of resilience, vibrancy, foresight and courage.

He noted that in virtually all sectors of the economy, the great show of enterprise, creativity and patriotism by private businesses had kept the country’s economy strong, versatile and forward looking.

“It was the dynamism of the Nigerian private sector that ensured the raising of over $2.5bn that ensured the successful conclusion of the power divestment process,” he said.

Jonathan added that the Federal Government was setting up a Power Sector Intervention Fund to enable industry players to have access to cheap and long-term funds.

He said the financial resources for the special fund would be pooled by the Federal Government, Development Financial Institutions as well as local and global financial partners.

The President said, “The Coordinating Minister of the Economy will give details of the operational structure of the fund. But, it will essentially provide avoidable refinancing and lending services to the sector.

“On its part, the Federal Government will make an initial deposit of N300bn, and I call on all participants to join hands towards the success of this endeavour.”

Also at the forum, the Group Managing Director/Chief Executive Officer, Diamond Bank Plc, Dr. Alex Otti, said Nigerian banks had so far invested N750bn in the power sector since the commencement of the privatisation exercise in the industry.

He also announced the readiness of the banks to plough more funds into the sector in order to end power outages in the country.

Otti described the Federal Government’s determination to improve electricity supply as good motivation to invest in the sector.

Otti expressed satisfaction with the level of improvement in the sector and assured investors that the power industry was worth investing in.